Most of us reading this blog post to earn money in some way, but do you have any idea about personal finance? If not, do you know where to start? Are you aware of where you spend or overspend in your monthly expenses? Where are you heading financially? To be honest, the answers to all of these questions are difficult for many to answer, which is why it’s really important to address them.

Hey guys, and welcome back to the updatediary.com. If you’re reading, then there’s a high probability that you’re interested in money. So, let’s start from the beginning and talk about the basics of personal finance. After all, what good is it to talk about the intricacies of money if we don’t discuss where and how to start?

What Are Personal Finance Basics?

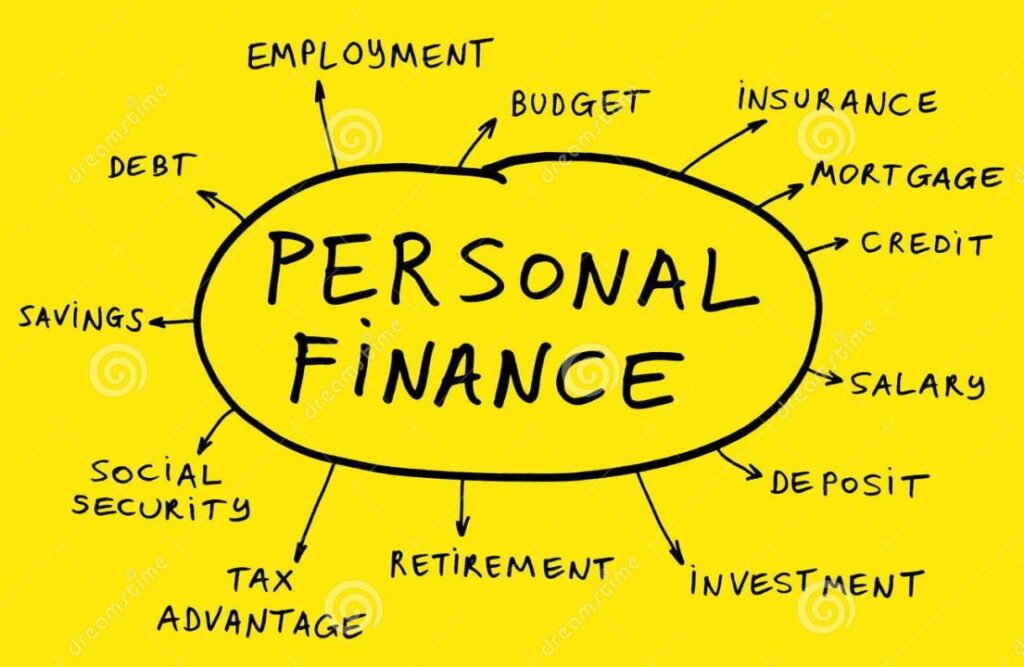

Before we can continue, it is necessary to discuss what personal finance actually means. Personal finance is the management of one’s finances through planning, spending, saving, and investing. It is the management of all areas of your, or your family’s, finances, both short-term and long-term.

The phrase also refers to an entire business committed to services and products meant to assist you in managing your finances and taking advantage of investment possibilities. Personal finance is an essential component of not just managing your day-to-day financial demands but also planning for your financial future.

The sooner you master personal finance, the better your long-term financial chances will be for things like investing and retirement planning. You can better identify possibilities to improve your finances if you grasp the elements of personal finance. This understanding can assist you in budgeting for immediate necessities while also planning for long-term financial goals. The sooner you begin financial planning, the better. Even if you think that boat has sailed, remember it is never too late to set financial objectives to provide financial security and freedom for yourself and your family.

Top Personal Finance Basics Habits and Tips

1. Personal Finance Basics: Set Specific Financial Goals

For everyone, financial success holds a different definition. For some, it’s having a credit score above 800, retiring before the age of 50, or assisting your children in avoiding student loan debt. Others may define success as owning a nice car, second property on the beach, or traveling around the world.

As with anything in life, not just your money, if you want to be successful, you must have a clear strategy. You cannot expect to fumble your way to achieving your financial goals. You must put thought, effort, and intentionality to determining just what you want in your financial life. Remember that your goals should be achievable and realistic, or else you will soon lose motivation because you’d have no way to truly track them.

2. Personal Finance Basics: Begin Budgeting Effectively

Budgeting is one of the fundamentals of personal finance; some might argue that it is THE fundamental to personal finance. To define it in a single sentence, budgeting is keeping track of your income and expenses, so you know where your money is going each month. When done correctly, a budget puts you in charge of your finances.

It allows you to spend more on things you enjoy and less on things you don’t. It allows you the flexibility to shift as life happens and new problems or priorities arise. A quick google or check in your phone’s app store will show you any number of budgeting apps designed to help you automate your life and make the process of tracking easier; apps like Mint, You Need A Budget, and Personal Capital.

3. Personal Finance Basics: Build an Emergency Fund

Paying yourself first ensures that money is set aside for unforeseen needs such as medical bills, a major car repair, increase in expenses, and more. The optimal safety net is to have an emergency fund of three to six months’ worth of living expenditures. Financial experts normally advise saving 20% of your pay to help you achieve this goal.

This may not be a quick thing. Some people take several months or years to save up enough for a rainy-day fund, but don’t get unmotivated. If you look at the big picture, it will be the emergency fund that saves you in trying times. Continue allocating as much as you can, preferably at least 20% to this goal.

4. Personal Finance Basics: Reduce and Manage Debt

To prevent debt from spiraling out of control, don’t spend more than you earn. Of course, that’s often easier said than done, and the truth is, most people must borrow from time to time. Also, going into debt can occasionally be advantageous, for example, if it leads to the acquisition of an asset. Taking out a mortgage to buy a property is an example of this.

Still, take a hard look at what items you’re obligating yourself to paying off. If it is not debt that allows you to build an asset or something that helps you bring in income, be very cautious about obligating yourself to paying it back. This includes things like cars, tech appliances, and any myriad of items that you’re tempted to put on your credit card.

5. Personal Finance Basics: Start Investing Wisely

Investing is the acquisition of assets that are projected to create a rate of return in the belief that the individual would get more money than they first invested. Investing does involve some risk, so ensure you know and understand what you’re investing in completely before you put your hard earned money into it.

Investing is one of the most challenging aspects of personal finance and one of the areas where many people seek professional help the most. There are significant disparities in risk and reward among various assets, and most people seek assistance with this part of their financial plan. Risk tolerance is different from person to person, and knowing your own will help you determine the best ways for you to invest.

6. Personal Finance Basics: Use Credit Cards Cautiously

Credit cards can be significant financial traps, but it’s almost impossible to survive without one in today’s world. Additionally, they are a crucial component to help build your credit score and a terrific tool to track spending, which can be a huge budgeting help. Credit simply needs to be managed correctly, which means paying off your entire bill every month or at the very least keeping your credit usage ratio low, that is, keeping your account balances below 30% of your total available credit.

Given the incredible rewards incentives available these days, such as cashback and points, it can make sense to use your credit card more often as long as you pay your bills in full. Remember, never use your credit cards to their maximum limits, and always pay your payments on time. Paying bills late or missing payments is one of the quickest ways to destroy your credit worthiness.

If you’re honest with yourself and know credit cards will get you into trouble, then cut it up and use a debit card. This is not about ego; do what you must to help get you to your financial goals.

7. Personal Finance Basics: Plan for Your Family’s Future

When the time approaches, all of us will die one day; we can’t escape it. But doing certain things can ensure that your wishes and finances carry on. It’s never easy to think about things like this but making your wishes known to the necessary individuals in your family will only help in the long run.

Create a will and, depending on your needs, set up one or more trusts to protect the assets in your estate and ensure that your desires are carried out after you die. It would be best to consider a car, home, life, disability, and long-term care insurance. Review your policies regularly to ensure that it matches your family’s needs during life’s big milestones.

8. Personal Finance Basics: Take Time Off and Enjoy Life

The pursuit of personal finance will span decades of your life. Budgeting, planning, saving, and investing can often be very tiring exercises. Make sure to treat yourself every now and again so that you don’t get demotivated. Ultimately, life is short, so enjoy some of the fruits of your labor, whether it is a vacation, a purchase, or a night out. This provides you with a taste of the financial freedom you are working so hard for.

Also, delegate when necessary. Even if you can do your own taxes or manage a portfolio of individual equities, this does not imply you should. Setting up a brokerage account and spending a few hundred dollars on a certified public accountant or a financial planner might be an excellent approach to help your planning.

Conclusion: Mastering Personal Finance Basics for a Secure Future

When you have financial literacy, you grasp all of the facts, tools, and principles required to manage your money wisely. Unfortunately, financial literacy is not taught in many school systems. If you want to be successful with your finances, you must seek out this information. Taking the time to learn and grow in the basics of personal finance can only help you on your way toward financial freedom. That’s the end of today’s video. If you learned something new today, like this posts and share it with your friends.